The basic premise of a commercial real estate investment is this: a property is purchased, the space within it is leased to rent-paying tenants, rental income is used to pay operating expenses and debt service, and any money left over is distributed to the property owner.

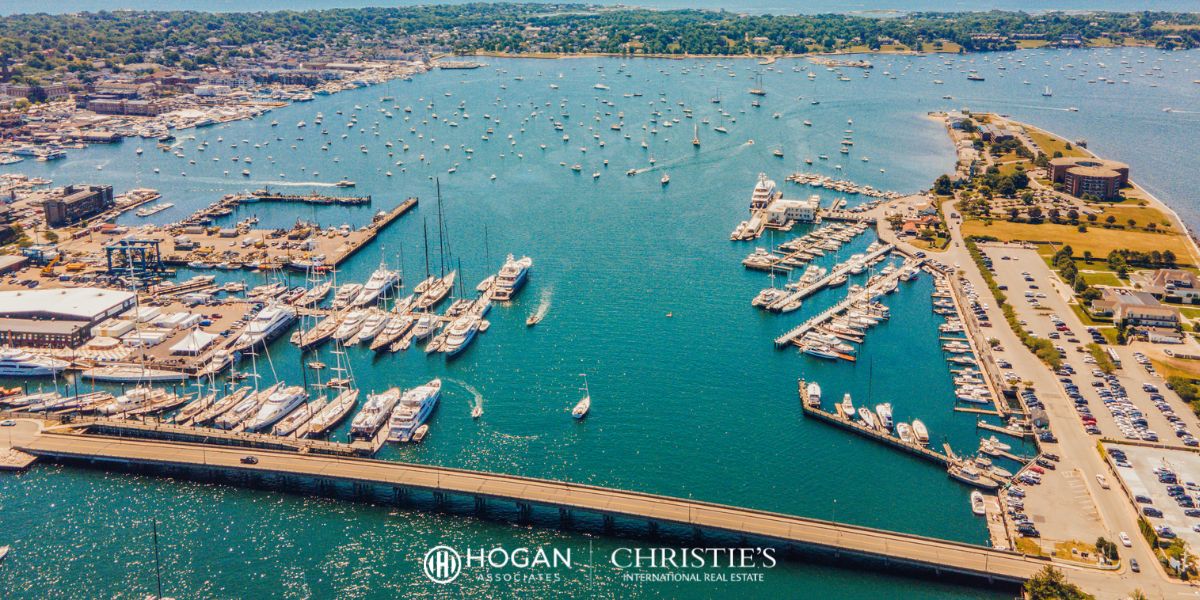

This business plan applies to many common CRE asset classes like office, retail, multifamily, industrial, hotel, and self-storage. It can also apply to less common asset classes, such as a marina. In this post, I’ll address the risks and benefits of owning one.

What is a Marina?

A marina is much more than a place that rents boat slips. While they are a place to park boats, they are also gas stations, new boat dealerships, storage facilities, boat maintenance shops, boat rental locations, retail stores, and even restaurants. Given the breadth of boat-related service offerings, it is more accurate to describe a marina as a diversified, full-service, boat-related business.

Benefits and Risks of Marina Ownership

The business case for marina ownership is this:

- Real Estate: By definition, marinas must be on or near the water. As such, the real estate they occupy is often in a prime, unique location. This element of scarcity helps to minimize the risk of investment for marina owners.

- Income Diversification: As described above, marinas benefit from multiple income streams that can help smooth out seasonal variations in traffic and income. For example, summer may be peak boat slip rental and restaurant season, but income from haul-out dry storage and maintenance in the winter can help marina owners get through slower seasons.

- Scarcity: Except for the most popular locations in places like New York and Florida, there may be only one or two marinas near a freshwater lake or ocean location. Less competition gives marina owners pricing power and increases the odds of keeping their slip occupancy high.

- Credit Risk: According to the United States Coast Guard, 69.8% of boaters have households with an annual income of $75,000 or more. As such, the marina clientele tends to be relatively affluent individuals who represent lower credit risk.

- Income: If managed efficiently, a marina investment should produce a steady stream of distribution income for its owners, providing a healthy return on investment.

However, owning a marina is not without risk. The benefits described above should be weighed against the following risks.

Risks of Marina Ownership

Some of the risks of marina ownership look similar to a traditional commercial real estate asset. These include things like:

- Missed Payments and Collections: Boat slip tenants could make late rent payments or refuse to pay their rent at all. Just like a traditional property, it can take a lot of effort and resources to chase these payments, which can reduce the profitability of a property.

- Liability: Boating is an inherently risky activity and the risk is compounded by a marina’s proximity to the water. Slips/falls and boat crashes are two sources of potential liability. In addition, those that sell gasoline could be exposed to even higher risks. Other investment risks unique to the marina industry include:

- Seasonality: Summer is the prime season for the marina business. The other seasons may experience significantly reduced sales volume and cash flow. Other lines of business could potentially mitigate this risk, but the bottom line is that boatyards can be a very seasonal small business.

- Natural Disasters: Because marinas are waterfront property, they are particularly vulnerable to unforeseen weather events. In the summer, they could be damaged by a hurricane or flood. In the winter, marinas located in the north could be damaged by encroaching ice or particularly bad winter storms.

- Wear & Tear: This risk is particularly prevalent for saltwater marina operators. The salt in the air and the wear and tear caused by tidal changes can be particularly damaging to the wet slip structures.

To mitigate these risks, marina owners must commit capital to maintenance costs and follow all environmental regulations to ensure the safety of the marina for both human and aquatic residents.

Marina Ownership Economics

The economics of owning a marina are remarkably similar to those of traditional commercial real estate assets. Let’s break down each of the major components.

Income

The primary source of income for a marina is the number of slips available for rental, the size of the boat(s) that the slips can accommodate (bigger are more expensive), and the rental rate for each. To supplement this income, balance seasonal variations, and cater to customer needs, marinas have complementary services like gasoline, repairs, maintenance, storage, boat sales, and food. These other sources of income are also levered to the number of boats in the marina and the popularity of the location.

Operating Expenses

The operating expenses for a marina are similar to those of an office building or multifamily property. They include property taxes, insurance, maintenance, legal fees, admin, utilities, and security.

Cap Rates

Marina cap rates can vary widely by market, location, occupancy, profitability, class, and cash flow stability. Cap rates can range from 8% – 14%, with averages in the 9.5% – 10.5% range. Of course, well-placed marinas with stable cash flow can trade below this range and those that have more uncertainty can trade above it. The higher average cap rates represent the incremental risk over traditionally stable CRE asset classes like multifamily.

Debt

Given the incremental risk and marina management expertise required, it is unlikely that a traditional retail bank lender will finance a one-off marina deal without special circumstances. Potential buyers will likely have to work with a brokerage or specialty lender that has specific expertise in the marina space. Even then, it is unlikely that the terms will be as generous as those for more traditional property types. Interest rates, down payments, reserve amounts, and debt service coverage requirements are likely to be higher while amortization periods are likely to be lower.

The key point about debt is that potential investors should understand the mechanics of these financing facilities and model the potentially higher costs to ensure that the marina income is high enough to cover them.

Deciding if Marina Ownership is Right for You

Waterfront locations, diversity of income streams, relative scarcity, and high net worth clientele make for a compelling business case for marina ownership. Being informed about the demands and risks of marina ownership will increase the likelihood of success. Those that decide to take the plunge into marina ownership may find that it is a unique, profitable, and fun investment.

If you’re considering purchasing or selling a marina, I’d be glad to offer my experience and insights. You can reach me, Gordon King, at (401) 924-1774 or Gordon@HoganRI.com.

Gordon King – Realtor Associate

Hogan Associates | Christie’s International Real Estate

(401) 924 – 1774

Gordon@HoganRI.com

About Hogan Associates

Hogan Associates is an independent Rhode Island brokerage founded by Leslie Hogan and Matt Hadfield, two of Rhode Island’s most experienced agents, each with a strong track record of success in the Greater Newport real estate market. Hogan Associates’ 36 sales agents work on behalf of buyers and sellers of fine properties in the coastal communities of southern RI. The firm has offices in Newport and Middletown and is a member of Who’s Who in Luxury Real Estate, an elite broker network with more than 130,000 sales professionals located in approximately 880 offices in 70 countries and territories. In 2020 & 2021 & 2022 Hogan Associates received Newport Life Magazine’s Best of Newport County award. For more information, visit HoganRI.com.

About Christie’s International Real Estate

Christie’s International Real Estate has successfully marketed high-value real estate around the world for more than 30 years. Through its invitation-only Affiliate network spanning 48 countries and territories, Christie’s International Real Estate offers incomparable services to a global clientele at the luxury end of the residential property market. The company and its affiliated brokerages have recorded approximately US$500 billion of real estate transactions over the last five years. For additional information, please visit christiesrealestate.com.